Italy and the Netherlands have the highest taxes, the Eastern countries the lowest, while Spain is in the middle

Since the appearance of the coronavirus, certain voices have insisted that the tourist tax be withdrawn in the Spanish autonomous communities that collect it: Catalonia and the Balearic Islands. However, a detailed analysis of the rest of the European countries reveals that this is a popular tool which, moreover, has not disappeared with the COVID-19.

"Tourist taxes are widespread in southern Europe and before the impact of COVID-19 we noticed that several Spanish destinations had considered introducing a tax of these characteristics," Simon Smith, Policy Manager of the European Tour Operators Association (ETOA), explained to AGENTTRAVEL.

The association, which analyses in detail the tourism taxes on the European continent, has observed that in this context "some destinations have suspended or deferred the introduction of a tax" of this nature. However, they have also perceived "increases in fares in Catalonia" and point out that "the surcharge in Barcelona is scheduled for 1 January 2021".

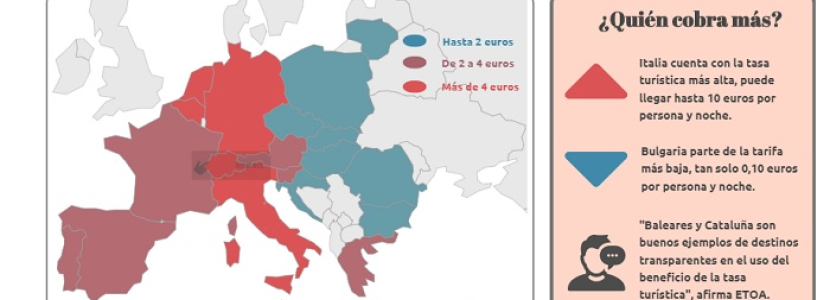

Currently, Catalonia charges visitors between 0.45 and 2.25 euros per night, with a maximum of seven nights; while the Balearic Islands has established a tax of 0.50 to 4 euros per person per night with a 50% reduction from the eighth night. Spain is among the European countries that charge a medium level of tourist tax.

If we look at neighbouring countries, Portugal has a tax of between one and two euros per person per night, up to a maximum of seven, while France is at the same level as our country, with taxes ranging from 0.20 to 4 euros per person per night. Greece is also in this tax bracket (between ?0.50 and ?4).

Eastern European countries, namely Lithuania, Poland, the Czech Republic, Slovakia, Hungary, Romania, Bulgaria and Croatia, charge taxes of less than ?2 and it should be noted that the Nordic countries, the United Kingdom and certain Balkan countries have not imposed any tax obligations on their visitors.

At the other end of the scale is Italy, which can charge up to ?10 per person per night in its most crowded cities - Venice and Rome. The Netherlands (up to 5.75 euros), Germany (up to five euros or 7.5% of the price), Belgium (up to 4.24 euros) and Switzerland (up to 4.65 euros) complete the ranking of the destinations with the highest tourist taxes.

The Balearic Islands and Catalonia, examples of transparency

For Smith, both the Balearic Islands and Catalonia are "good examples of transparent destinations in the use of income derived from the tourist tax". In his opinion, the destinations should specify the specific projects in which they reinvest the benefit of these taxes and both the Balearic Islands, which reports through its website, and Catalonia, which does the same through press releases, fulfil this objective in an appropriate manner.

Likewise, Smith considers that in order for a tax to be successful, the country imposing it must give advance notice of any increases it may undergo, as does Croatia, which has a specific law that makes it compulsory to announce any change in rates before the end of January of the current year. "Consultation with the tourism sector and notification of proposed changes is welcome," he added.

Unlike Croatia, Smith points out that Amsterdam's change of approach to the tourist tax, which combines a percentage of the room rate with a fixed amount - it is the only destination in Europe to opt for this hybrid model - has caused "confusion in the industry".

In addition to transparency for citizens and a wealth of information for visitors, factors in the success of the charge, as Smith points out, certain destinations offer small benefits to tourists who pay the tax. This is the case in Switzerland, which provides cards to use public transport and in Basel and Lucerne includes free wifi access and discounted tickets to attractions.

Deterrent effect?

Additionally, Smith considers that destinations should "take into account the cumulative effect of tourist fees when combined with other destination taxes, such as VAT and city access charges, as well as on multi-destination tours". In other words, it is advisable to analyse the consequences of such a tax before it has the dissuasive effects on demand that certain actors in the tourism sector warn about.

In any case, the ETOA expert does not believe that destinations should opt for the imposition of tourist taxes as a tool to stop saturation, but that their main objective "is to finance services such as infrastructure, promotion or tourist services". Furthermore, ETOA states that it has no evidence that "the tourist tax is an effective tool for managing demand", despite the fact that there are destinations "with reduced rates in the low season or depending on the location of accommodation in a city".

Given the current circumstances, the association recognises that especially local bodies "may be dependent on tax revenues to finance a destination" and in this respect tourism fees may play a determining role. However, Smith puts the focus on the "need to simplify taxes and allocate revenues fairly", a task which the European Commission appears to be undertaking by reviewing the special VAT regime for travel agents and tour operators.

"Now more than ever, it is necessary for a DMC based in Barcelona, say, to be able to compete effectively with a company based outside the European Union that seeks to package products for resale," Smith concludes.

Credits https://www.agenttravel.es/noticia-039568_La-tasa-turistica:-una-herramienta-popular-en-Europa-que-no-desaparece-con-la-COVID-19.html